bottom-up compliance

how SMEs can drive the move to smarter KYC

by Bob Blower

The global banks are caught between a rock and a hard place, with increasing penalties for compliance failures to be balanced against the spiralling costs of the due diligence required to stay compliant. It's no surprise that many choose to abandon sectors and regions that pose an uncommercial blend of risk, reward and onboarding cost.

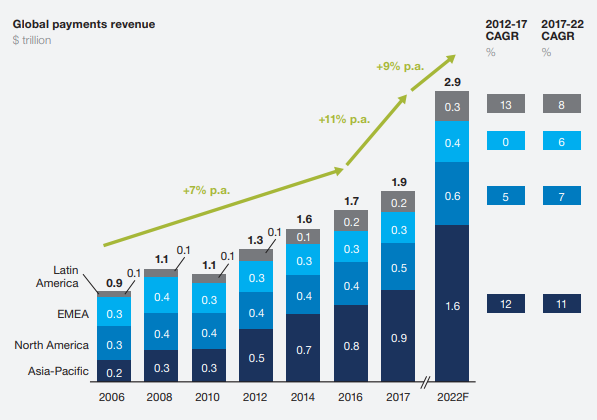

This leaves SMEs in affected regions with a huge problem; faced with an effective embargo on international trade, they're forced to look elsewhere in order to survive. Historically, this has often meant their resorting to "shadow banking", an unregulated wild west environment that can expose them to significant risk. But while barriers undeniably exist, global remittances continue to grow, with estimates predicting an annual value of almost $3 trillion by 2022. It's possible that this rise is being partly fuelled by the availability of technological advances in KYC. Solutions have emerged that allow safe, economical compliance, many of which can enable fully compliant transactions with little or no bank involvement.

These same solutions are available to banks, but the analogy of supertanker versus speedboat holds true here. The smaller companies have the speed and manoeuvrability to adopt new technologies, without the complex approval processes required by the larger organisations.

The advent of blockchain-based solutions is driving a revolution in secure-centric applications, with small to medium enterprises moving to centre stage in signposting faster, simpler and more dependable diligence procedures. Their low entry cost and speed of deployment suit them strongly to the needs of active, hungry businesses that are looking for quick and sustainable international payment enablers.

For the larger financial institutions, compliance is a growing cost to be set against the penalties for failure. UK banks are known to have set aside £264 for regulatory fines; for some risks, it's cheaper to accept the fine than to fix the problem. SMEs don't have this luxury. A single regulatory fine could spell bankruptcy. Faced with bank de-risking on one side and potentially disastrous fines on the other, they're forced to look for other solutions.

And, at last, the solutions are there to be found. Emerging regions no longer need to turn to shadow banking. SMEs looking to deal with those regions no longer have to choose between high transaction costs and delays or business-threatening risk.

Ultimately, the banks must follow. As their global payments business leaks away, they'll be forced to take action and join the revolution. The more nimble among them are already working on the change.

Those left behind may follow the dinosaurs.