free-flow business

Liquidity is the lifeblood of your business. It's the resource that allows you to meet your commitments, make payments on time and, essentially, be the company that others want to deal with. Hold-ups due to a particular currency being temporarily unavailable damage your reputation and make future transactions more difficult. And when you're awaiting payment from your customers, you don't want to be kept waiting for your invoices to be settled. We maintain ready liquidity in twelve currencies, including USD, EUR, GBP, CHF and ¥. That covers at least 90% of the transactions we're asked to service, but where needed we can provide over 100 other FIATs, including many exotics.how we do it

Like many good practices in business, our ability to meet payment requirements rapidly isn't based on a single solution. Relationships with currency institutions like Sucden and Bloomberg are an excellent resource, and we're able to access more than twenty currencies on demand at superb rates, but that's just one element of the mix...

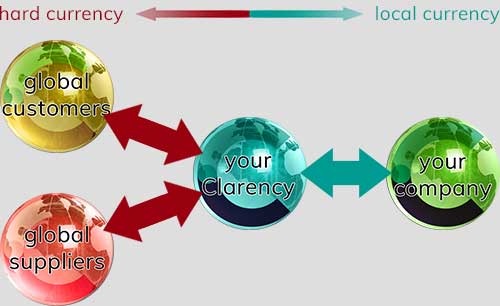

Our payments network allows us to balance many inward and outward flows, recycling hard and local currencies and so avoiding FX losses altogether for many payments.

The process is slightly different depending on whether you're a bank/NBFI or a business wishing to import or export goods.

importers and exporters

If you're exporting goods, we can not only make things easier, but make you more competitive in the process. And if you're importing, then ready liquidity in the required currencies and reduced losses in the supply chain help you to make better deals.

When a payment arrives, the vendor can choose to convert it to local or hard currency as required and enjoy excellent exchange rates. But even this expense can be removed by using the currency as-is to fund an outgoing payment. Take as an example a cross-border sale of manufactured goods; payment arrives in USD, which you could exchange for local currency. But instead you choose to use those dollars to purchase equipment from a hard-currency region. As there's no forex involved, you avoid losses in the buying and selling spread and make your money work harder.

There are further advantages too - take a look at our focus on your business sector in small to medium businesses and large corporates.

financial institutions

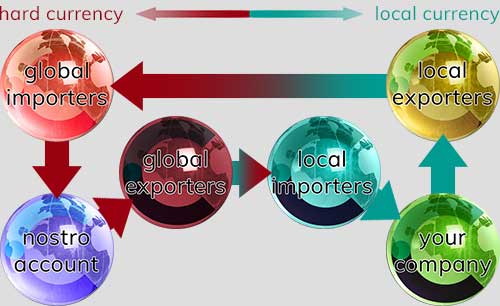

The process begins with our setting up a hard currency nostro account into which you receive funds. If you wish, you can then simply convert the payment to local currency and settle with your customer. But it's often better to settle your customer with local currency from your treasury. You're now free to sell the hard currency to a local importer, for whom you then route an outbound payment to their overseas supplier. By recycling hard and local currencies, you avoid FX losses, maintain revenue and can earn revenue on both incoming and outgoing payments.

And our approach for financial organisations extends still further than this. Take a look at our offering for banks and nbfis to learn how much further.

making your money work harder still

With low transaction fees, keen exchange rates, minimisation of forex losses, not to mention efficiency, speed and simplicity, biz.Clarency makes a very persuasive case for your business. But there's an added bonus. For certain account types, it's possible for you to earn a significant return on any funds you choose to leave within the ecosystem. So, for example, if you receive a payment but wish to leave some or all of it in the system for settlement of an upcoming outgoing transaction, you earn a return significantly above any you're likely to find elsewhere*.

* All our operations are carried out under the terms of our Major Payments Licence and in full compliance with relevant regulations.