employee hiring: is it time to change our approach?

how KYC can become KYE

by Mark Ballard

The concept that any business's main differentiator is its employees is so over-used that it's virtually a cliché. Every company will boast that its most important asset is its people, but is that statement backed by hard facts? That's not to belittle the essential human factor, but rather to question the sincerity of the claim, given that so few companies apply real care and diligence to their hiring process.

Think it through for a moment. You wouldn't contemplate advancing credit to a new customer without thorough checks, yet you're willing to allow a virtual stranger privileged access to your building and your processes, based on an hour's chat and a few token references - probably from people you also don't know. It's an opinion regularly expressed, usually with a shrug and an ingenuous grin, that everybody lies at interviews. Does it make sense that we're willing to accept that as an unavoidable fact?

Disturbingly, research shows that it is a fact. Hireright’s 2018 EMEA report reveals that 89% of HR recruiters experienced job applicants falsifying information. This is an unacceptable status quo that is, somehow, being accepted.

Daring to Check

But if increased vetting of applicants is needed to protect a business from the threat within, how does that work in an increasingly competitive job market? Employees move jobs ever more fluidly. Only a decade ago, a CV demonstrating nomadic tendencies would be regarded with suspicion; today it's the norm. Hiring is now a seller's market; if you want the pick of the best candidates, your recruitment process needs to combine the polish of Cirque du Soleil with the predictive powers of Nostradamus, then add in Sherlock Holmes making astute observations on the origin of mud splashes.

We should bear in mind that accurate matching of applicant to position isn't just in the employer's interest. In most cases, a bad choice will cost the company a regrettable but manageable chunk of money. But it can have a lifelong impact on the employee. It's in everyone's interest to make the right decisions, and recruiters should make this fact explicitly clear to applicants. But still, to be competitive, we have to make the recruitment process user-friendly. Demanding intrusive background detail creates an early negative experience for the applicant.

But hang on a moment. Psychometric testing is still widely used in recruitment, despite many expert voices decrying its effectiveness.The Paul Flowers appointment as chairman of Co-operative Bank shone a bright light on a selection technique used by 80% of Fortune 500 companies. It's not the role of this article to question the effectiveness of properly engineered and expertly interpreted psychometrics, but there are plentiful poorly conceived tests around, with results as open to varied interpretation as a horoscope. My point here is that few things can be as intrusive as a set of questions designed to reveal your "secret" self. If we're willing to impose an esoteric test with potentially questionable results, why not instead introduce something more factual?

Accurate Recruitment Creates Engagement

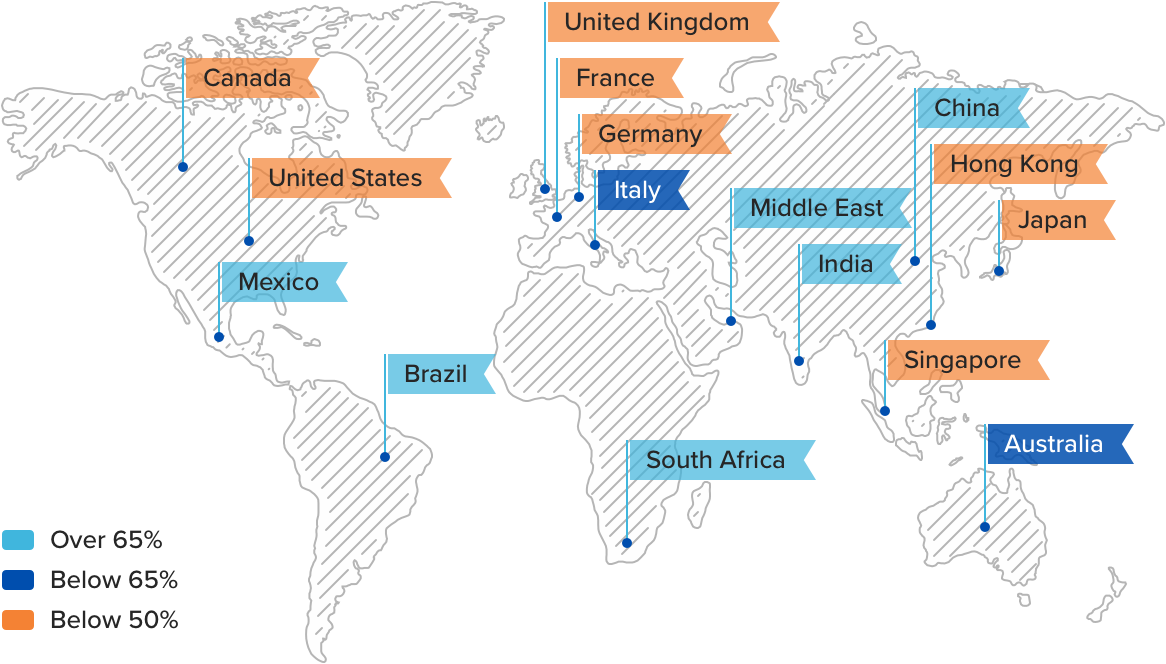

Employee engagement becomes increasingly important, as work forces become more fluid and remote working becomes more widespread. Engagement promotes staff retention and can be shown to link positively and directly to growth. With reduced long-term contact with colleagues, how do we engage and retain employees? The map below makes interesting viewing, showing that many of the world's top economies lag severely compared to emerging regions.

Employee acquisition costs are soaring, retention rates are falling, and much of the established world seems to be content with that.

"I don't want the best employees. I want the right employees. The best engine in the world is a Rolls Royce jet engine. But it's a bad choice if you're building tractors."

Jack Ma, Founder of Alibaba

Can KYC Techniques Help?

In many ways, recruiting a new employee is little different from onboarding a new finance customer. And, given the Co-operative Bank debacle, the risks may be even greater. We want to select the right person, who'll not only do a good job, but also enjoy what they're doing and, as a result, want to stay in post. Any application process will involve some degree of background checks, if only work and personal references. But these are easily - and commonly - falsified. With so much at stake, doesn't it make sense to look beyond the volunteered information to seek out the real picture?

The latest KYC systems, of which biz.Clarency is a cutting-edge example, can work from a quick and simple upload of statutory documents like a passport or driving licence. It's an easy and non-invasive basis from which detailed background checks can be made. It's possible within minutes to build a detailed view of an applicant's employment history, social media interactions, court records and many other factors. This information is presented in a clear, factual form that allows truly informed decisions to be made. Recruitment can become more fact- rather than opinion- based, becoming more dependable - and ultimately more defensible in the event of an adverse event than Co-operative's statement that Paul Flowers' psychometrics looked okay.

The information gathered can have a positive effect on an employee's engagement and happiness. A good recruiter can place the new starter accurately, fully aware of any support mechanisms or training facilities that will be needed for optimum development. The facial recognition capabilites built into the system can even be used post-hire for access control.

Post-Employment

The best KYC systems continue to monitor their subject. This gives a living insight into changes in employees' situation, allowing such changes, positive or negative, to be dealt with in an optimum manner. Employee stress can be reduced, help offered where necessary and potential problems sorted before they become actual problems. At lower pay levels it can even be used to help unbanked individuals to acceptance for accounts or lending by banks.

And on the less positive side, ongoing monitoring can lessen a company's exposure to employee fraud, or provide persuasive evidence of due diligence if something does go wrong.

What About GDPR?

This may all sound threateningly Big Brother, but consider the information that we all currently share with the likes of Google and Facebook. What was your reaction when you received an e-mail from Google inviting you to view your travels over the last year? I guarantee that, after that first moment of doubt, you clicked through interestedly to see where you'd been. The fact is that GDPR places no obstacles to gathering any information that's relevant to your task, provided you get the subject's permission to do so. As long as your recruitment form clearly states how you're proposing to process the applicant's information, all's well. And you already have that in place.

Don't you?